Hot Off The Press: June Market Report

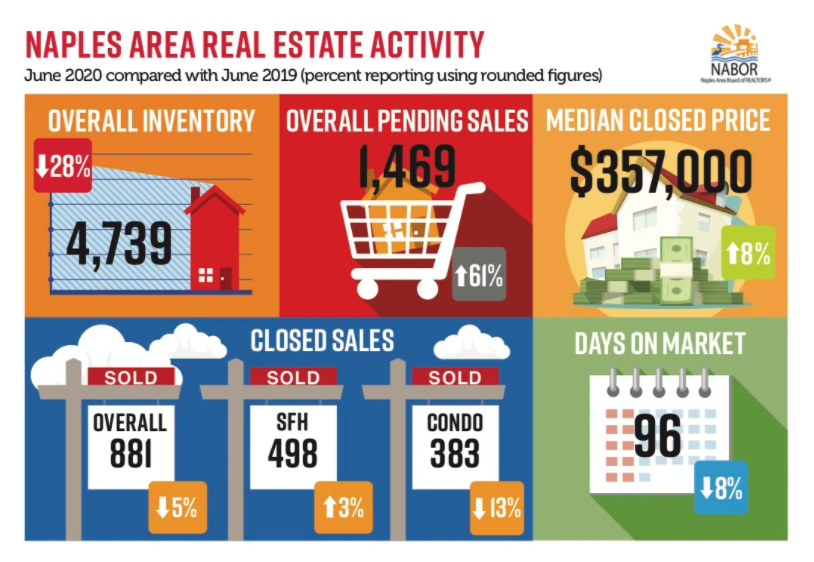

Naples, Fla. (July 24, 2020) – According to the June 2020 Market Report released by the Naples Area Board of REALTORS® (NABOR®), which tracks home listings and sales within Collier County (excluding Marco Island), pending sales (homes under contract) increased 61.3 percent compared to June 2019, with single-family homes being the home choice for a majority of buyers. Broker analysts reviewing the report also noted that new listings during June increased 25.8 percent compared to June 2019, which indicates growing consumer confidence for both sellers and buyers leading into the summer Naples real estate market.

The everlasting desirability of the Naples real estate market was undeniable in June, especially in the single-family home market where pending sales increased 83.9 percent to 835 pending sales from 454 pending sales in June 2019. Pending sales of condominiums during June increased 38.7 percent to 634 pending sales from 457 pending sales in June 2019.

“The Naples residential market is showing signs of rebounding after a temporary pause in activity caused by the pandemic during the latter part of March, and through April and May,” said Budge Huskey, CEO, Premier Sotheby’s International Realty. “Naples seems to be the beneficiary of a migration of people making life changes and coming to our market. Contributing factors are our low density and coastal properties.”

While closed sales in May were down nearly 50 percent compared to May 2019, closed sales in June decreased only 4.6 percent to 881 closed sales from 923 closed sales in June 2019. However, according to Brenda Fioretti, Managing Broker with Berkshire Hathaway Home Services Florida Realty, “June had the third highest number of showings this year, behind the historically high showing months of January and February. In comparison, there were 36,912 showings in June compared to 42,299 showings in January and 44,137 showings in February.”

Before the pandemic, the number of closed sales of single-family homes and condominiums was about equal each month; but the June Market Report revealed a shift in buyer preference to single family homes compared to June 2019, as closed sales of single-family homes increased 2.9 percent to 498, while closed sales in the condominium market decreased 12.8 percent to 383. This trend could be attributed to buyers wanting a larger home with more space to accommodate working from and sheltering at home.

Inventory decreased 27.6 percent to 4,739 homes in June from 6,547 homes in June 2019. The majority of this depletion was reported in the single-family home market, which decreased 34.5 percent, while the condominium market had a decrease in inventory of 20.3 percent. The report also showed the largest drop in inventory occurred in the $300,000 to $500,000 single family home market, which decreased 47.7 percent in June compared to June 2019.

As a result of heightened buyer demand, the median closed price increased 8.2 percent to $357,000 in June from $330,000 in June 2019. Bill Coffey, Broker Manager of Amerivest Realty Naples, remarked, “The overall median closed price increased in June because the luxury market is hot this summer, and the level of demand is driving up the prices, particularly in the $1 million and above market.”

Coffey’s comment was validated by other brokers reviewing the report including Huskey and Phil Wood, President & CEO of John R. Wood Properties, who both claimed their offices saw multiple offer situations in the luxury market during June. Fioretti added that her agents reported multiple offers in every price point during June.

Wood added that closed sales for the year are not yet on track with last year’s activity due to the pandemic, yet he’s optimistic because “as of June, the number of closed sales were only 400 less than last year at this time.” He added, “When the stock market dropped at the beginning of the pandemic, high-end buyers hit pause. But the stock market is strong today and these buyers – who we typically only see during high season – are seeking to buy luxury properties in Naples this summer.”

SOURCE: Naples Area Board of Realtors